SSS Pay Cards

Cards for Different Needs

At SSS PAY, our diverse card offerings cater to a wide range of financial needs, providing tailored solutions for both individuals and businesses to manage their finances effectively and securely.

Quantum Card

Ideal for high-frequency transactions, Quantum Cards are designed to handle frequent payments seamlessly. With enhanced transaction capabilities, these cards are perfect for individuals or businesses with a high volume of financial activities.

Employee Card

Streamline corporate expense management with Employee Cards. These cards provide a convenient solution for tracking and controlling employee expenditures, making it easier for businesses to monitor and manage their finances efficiently.

Budget Card

Take control of personal finance management with Budget Cards. These cards are designed to help individuals set and stick to financial goals by providing tools for budgeting and tracking expenses, promoting responsible spending habits.

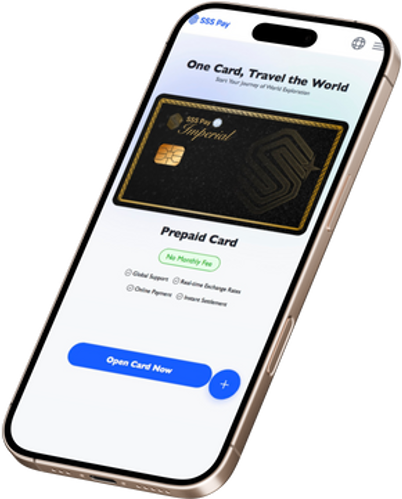

Prepaid Card

Manage spending effectively with Prepaid Cards. Offering a controlled spending solution, these cards allow users to load a specific amount onto the card, helping individuals stay within budget limits and avoid overspending.

White Label & Custom Cards

Tailored for businesses seeking customized payment solutions, White Label Cards offer branding opportunities and tailored features to meet specific business requirements.

VIP Cards

VIP Cards cater to high-value clients with exclusive benefits and privileges, providing a premium payment experience with enhanced services and rewards.

Physical & Virtual

Ideal for high-frequency transactions, Quantum Cards are designed to handle frequent payments seamlessly. With enhanced transaction capabilities, these cards are perfect for individuals or businesses with a high volume of financial activities.

Key Benefits

SSS PAY prioritizes data security with advanced encryption technologies to protect sensitive information.

Our measures safeguard your account against fraud, ensuring a secure payment experience.

Monitor transactions, balances, and spending patterns in real-time for informed financial decisions.

Robust features like fraud detection protect your finances from unauthorized access and theft.

Allocate funds across categories to manage expenses effectively and stay within your financial limits.